How to Find Financing For Your Metal Barn

Farmers are constantly searching for ways to improve their property and the farming operations, and the new generation of the metal barn provides some useful options. Not only are they easy to build and modify, but quick to construct and inexpensive to maintain. In addition, the non-combustible nature of the materials makes metal buildings a safer option for a farmer’s livestock – and livelihood – than traditional building solutions. The critical question, however, is how do farmers obtain financing for agricultural metal buildings such as barns, storage facilities and even homes?

Farm credit options

Farm credit is available through a variety of lending institutions. From the traditional line of credit through a bank or credit union to financing the construction of a metal barn using credit cards, commercial farmers have a number of options available. In some cases suppliers of steel buildings offer payment plans, and various government-run lending agencies also provide ways to fund these buildings. It’s a case of finding the right loan for the individual farmer’s circumstances and credit rating.

Potential lenders

Lending institutions that offer financing specifically for agricultural buildings are aware of the value of metal construction and are very willing to consider loan applications for this purpose. Farmer Mac, the Federal Agricultural Mortgage Corporation, offers loans through a nationwide network of lenders. From standard mortgages through to long-term loans with fixed-rate funding, eligible borrowers can apply directly to Farmer Mac’s lenders for financing under the various programs offered.

Other national lending agencies such as the Farm Credit Network work in a similar fashion, although as a network of cooperatives the system lends money generated by the sale of U.S. debt securities instead of relying on federal funding. Combined, Farm Credit organizations provide more than $235 billion in loans, leases, and related services, which is more than a third of the credit needed by U.S. agriculture, according to the website. This capital helps nearly 500,000 borrower-owners plant and nurture seeds, purchase and care for livestock, buy land and equipment like harvesters and combines, build barns and milking parlors, and expand storage, packing and processing facilities.

States frequently have their own farm credit programs, too. The Agricultural and Small Business Development Authority in Missouri, for example, offers eligible farmers money for loans that can be used for farm buildings or agribusiness ventures. Farm credit lenders understand the cyclical nature of farming, and often specialize in lending for a particular type of farming. They may structure loan repayments monthly or perhaps annually, if the farmer’s income is generated by a specific event such as the harvest.

Applying for a loan

In many cases, farmers can apply online to make the initial contact with a potential lender, while in smaller centers lenders may prefer to deal personally with their customers. As with any loan application, it’s wise to shop around and try to find the best interest rate. This varies depending on the lender, the type of farming and the purpose of the metal barn. Farm Credit Mid-America, for example, offers fixed-rate loans for up to 10 years for crop farmers, as well as many other adjustable or variable-rate loans. And if a farmer isn’t eligible for commercial farm credit but still needs to construct a metal barn, the USDA’s Farm Service Agency offers direct loans or loan guarantees of up to 95% to help farmers “bridge” the gap to commercial credit. I always recommend speaking to a finance professional to learn about your options and make the correct decision for your situation.

Getting a quote

The first step towards finding farm credit for a metal barn is determining what the final cost is likely to be. How do you calculate the total price of a metal building? Farmers typically contact Armstrong Steel with the dimensions of the building that they need. Metal buildings are usually half the cost of other traditional construction methods, and can be erected in half the time. Farmers can focus on their equipment, animals and crops instead of constantly repairing

We’re always looking for different ways to help farmers and first time builders get a metal barn directly from the factory! Do you have any other suggestions to obtain the financing you’ll need? Start the conversation below!

« 5 Expert Tips for Your Steel Building Purchase

Good News: Steel Prices Are Low…For Now »

Popular Posts

If you have mastered the art of cramming your belongings into every nook and cranny of your house, or your closets are bursting at the seams, it may be time to look into more storage space. A steel garage is one of the most economical, durable and versatile solutions on the market today, and they… …

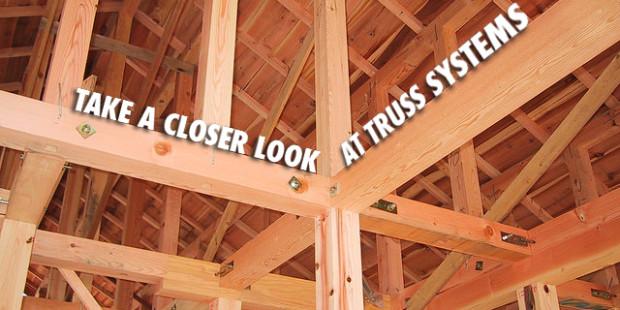

While doing your research and trying to decide what style or type of building you want, I’m sure you’ve seen the term ‘truss buildings’ or truss systems. What exactly is a truss system and should it be an option for you and your building? A truss system is generally a framework of triangles used to… …